Your bank will never unexpectedly contact you and request the following:

Always protect yourself

Scammers don’t discriminate.

Cyber-attacks are becoming increasingly sophisticated and anybody can be targeted. We have a dedicated team looking for suspicious transactions and activity across your accounts, but it’s important to remain vigilant and keep your personal information secure.

Get in touch if:

- Anyone from your bank unexpectedly contacts you via phone, SMS, email, or social media and requests your personal details, PIN, passcode, password, or one-time password

- You suspect your access codes or PIN have become known by someone else

- You see any unauthorised transactions on your account/s

- You’re concerned that you’ve become a victim of a scam or fraud

- Your card, phone, passbook or cheque book is lost or stolen

- You have moved and need to update your details

- You’re being blackmailed with threats of sharing your personal information or images. Don’t make any payments or meet their demands. Keep evidence of the conversation and immediately report this incident.

For more information on identifying scams, see The Little Black Book of Scams provided by the Australian Competition & Consumer Commission.

Current and common scams

Finance and investment scams

We’ve made a list for you to check twice to find out about the financial and investment scams that aren’t so nice.

Cost of living scams

Be aware of these four schemes that scammers are using to take advantage of the rising cost of living.

Online sale scammers

Online sales are opportunistic for bargain hunters but also scammers and impersonation sites are on the rise. Here are some of the signs to look out for to avoid sneaky scammers.

Identifying buying or selling scams

Online purchasing scams can target both sellers and buyers, so it’s important to be aware of the signs to identify and avoid the following common scams.

Business email compromise scams

Fraudsters often use email to impersonate a legitimate business or valid employee for financial gain. Spot the signs to avoid becoming a victim.

Spotting a remote access scam

Scammers usually pose as someone from a reputable organisation to gain access to your private data. These are the signs to look out for.

Spike in 'Hi Mum' scams

Would you always respond without question to a message from a friend or family member asking for help? Many of us would – but doing so right now could get you into financial hot water

Illegitimate Fraud Scam - targeting elderly customers

Recently, criminals have been targeting both Greater Bank and Newcastle Permanent customers as part of an elaborate scam to have elderly customers withdraw funds from ATMs.

Pensioner card scams

A new scam is currently targeting older Aussies that use the pretence of a discount card to get money and personal information from seniors.

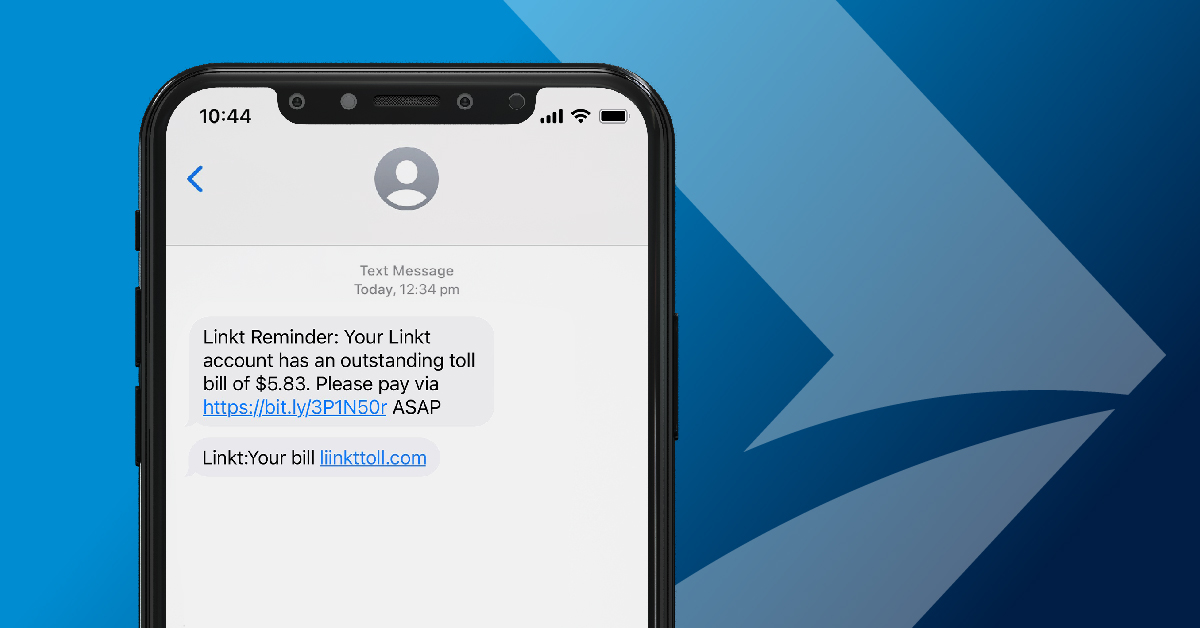

E-Toll Scams

Have you or a loved one received an email or text that says you owe money for tolls? Before you respond, make sure the message is legitimate.

Impersonation Scams

Impersonation scams are becoming increasingly sophisticated and anyone can be targeted. In this deceptive practice, scammers act as trusted people to steal your finances and personal details.

Tips to protect your money and identity

You can take the following steps if your personal information has been compromised:

- Contact us as soon as possible so that we can add additional control measures to your accounts

- Change the password for your online banking and social media accounts

- Report the matter to the Australian Cyber Security Centre at cyber.gov.au

- Continue to monitor your accounts for any suspicious activity or notifications

- Replace any stolen ID documents. Visit ID Support NSW for help with updating government issued IDs such as licence, Medicare card or passport

- Get in touch with the data leak source if it’s a business provider for more information about other actions to take.

As an increased security measure, please be aware our staff may ask some questions about the purpose of a transaction to ensure the enquiry is not the result of scam activity.

- Ensure that you have the latest anti-virus protection software on your computer and update your operating system software on your phone when prompted

- Limit the amount of personal information on your phone and online social media profiles, that could be used to steal your identity

- Never access the app or online banking from a link in an email or SMS

- We recommend to only use trusted Wi-Fi networks where you know the connection is secure, such as at home or possibly your workplace. Public Wi-Fi networks aren't always secure so it is best to use mobile data instead.

- Keep all receipts and transaction records and check the details on your statements

- Use secure payment methods when making a purchase online

- Be aware of fake sellers. Check the logo, business name and URL address

- Check and make sure it is a reputable site by looking for the padlock symbol and ‘https’ at the start of the web address (not http) or using a reputable website checker tool.

Keep your codes (PIN, passcodes and passwords) safe.

- Use a passcode and/or biometrics (registered only to you) to protect access to your phone

- Don’t tell anyone your codes, including friends, family, or someone claiming to be from Greater Bank

- Don’t write down or store your codes on your card, phone or anything that could be lost or stolen

- If you do need to record a reminder, make efforts to disguise it. Never give your card or phone used to access banking apps to anyone

- Cover your PIN when you enter it at an ATM or when accessing online banking or the app

- Choose your own codes and don’t use anything easily guessed such as your birthday, name or phone number, or numbers that form a recognisable pattern

- Check ATMs for any obvious signs of tampering

It’s important to know you are responsible for losses from unauthorised transactions if you don’t protect your PIN and access codes.

Despite any guidance we provide, our liability for any losses incurred by you resulting from unauthorised transactions will be determined by the ePayments Code.

For security reasons, our staff may ask you a series of questions when you request large cash withdrawals or changes to transfer limits to protect you against financial scams.

We may also ask you to provide ID to verify your identity and help keep your accounts safe.

Always exercise caution when using your card or cheques:

- Sign your card as soon as you receive it, and cut up any old card into pieces before disposing of it

- Don’t let your card out of your sight when making a purchase

- Cheques should be treated like cash and kept secure when not in use

- Never pre-sign cheques or withdrawal forms.